Source from: http://feedproxy.google.com/~r/TaxPolicyBlog/~3/Vr7lVYuGGTM/

- Who Shoulders the Load of Federal Income Taxes?

- America Already includes a Progressive Tax Strategy

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percentage's Tax Charges On Time

- Who Gains from Itemized Deductions?

[1] The corporate income tax percentage is that the CBO's estimate of their prevalence of this tax.

[two ] CBO's step of means-tested transfers comprises money payments and in-kind transports from national, state, and local governments.

Policymakers have recently proposed various ways of increasing taxes on the wealthiest Americans and creating the tax code more progressive, such as riches taxes, estate taxes, plus a greater marginal income tax rate. Changing the tax program, but requires first understanding the way it currently operates, and what sorts of transfers are already in place.

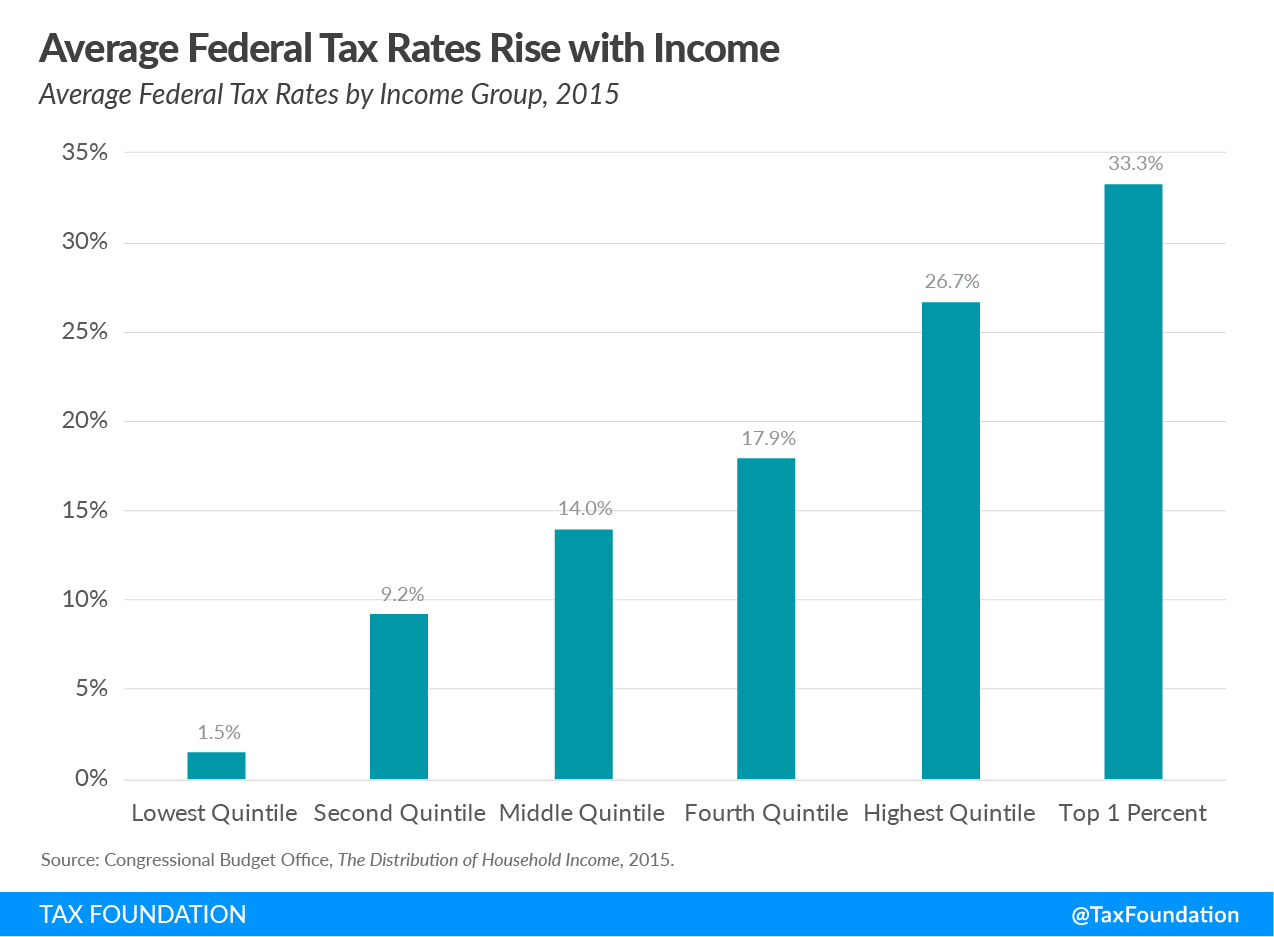

Data in the Congressional Budget Office (CBO) illustrates the progressivity of the federal tax code and the impact of transfers from high-income to low-income Americans. The subsequent figure shows typical federal tax rates--complete federal taxation divided by total income before transfers and taxes--from income group in 2015. Note: This is part of a blog series called “Putting a Face on America’s Tax Returns” Stay Informed on Tax Policy Research and Investigation Select State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming

The end result of all federal transfers and taxes is a redistribution of revenue in large - to low-income households. According to the CBO,"In 2015, average household income before accounting for means-tested transports and national taxes was $20,000 for the lowest quintile and $292,000 for the maximum quintile. After transfers and taxes, these averages were 33,000 and $215,000." [2] Quite simply, the lowest quintile's average family income rose by 11,000, while the maximum quintile's average household income dropped by $77,000.

The end result of all federal transfers and taxes is a redistribution of revenue in large - to low-income households. According to the CBO,"In 2015, average household income before accounting for means-tested transports and national taxes was $20,000 for the lowest quintile and $292,000 for the maximum quintile. After transfers and taxes, these averages were 33,000 and $215,000." [2] Quite simply, the lowest quintile's average family income rose by 11,000, while the maximum quintile's average household income dropped by $77,000.

The lowest quintile's income nearly doubles, although the second and middle quintiles experience comparatively smaller gains in earnings. The fourth quintile's income share remains steady, and only the highest quintile has a reduced share of earnings after transfers and taxes. The top 1 percent's share of earnings, by way of example, falls from 16.6 percent to 13.2 percent.

The lowest quintile's income nearly doubles, although the second and middle quintiles experience comparatively smaller gains in earnings. The fourth quintile's income share remains steady, and only the highest quintile has a reduced share of earnings after transfers and taxes. The top 1 percent's share of earnings, by way of example, falls from 16.6 percent to 13.2 percent.

As policymakers debate means to raise taxes on the wealthy, they ought to keep in mind the degree to which the federal government already transfers earnings between income classes and remember that America currently has a innovative tax program . This circumstance is essential for productive discussions on the best way best to improve the tax code, rather than weaken it.

Stay Informed on Tax Policy Research and Investigation

Select State

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

As policymakers debate means to raise taxes on the wealthy, they ought to keep in mind the degree to which the federal government already transfers earnings between income classes and remember that America currently has a innovative tax program . This circumstance is essential for productive discussions on the best way best to improve the tax code, rather than weaken it.

Stay Informed on Tax Policy Research and Investigation

Select State

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

Income Tax Attorney in Tacoma WA

Federal taxes can be further broken down into personal income taxes, payroll taxes, corporate income taxes, and excise taxes. The following graph shows average federal tax rates for each type, illustrating the way the progressivity of the federal tax code changes by tax source.

While the general federal tax system is advanced, not every tax which comprises it is. The individual income tax is the most progressive, falling most heavily to the highest quintile. The lowest two quintiles encounter a negative income taxation –in other words, their income rises –as a result of lien tax credits like the Earned Income Tax Credit and the Child Tax Credit. In 2015, the lowest quintile’s average payroll tax rate was 9.8 percent, in comparison with the maximum quintile’s rate of 6.5 percent. In the same way, the lowest quintile’s typical annual tax rate was 2.4 per cent, in comparison with the highest quintile’s speed of 0.4 percentage.

- Who Shoulders the Load of Federal Income Taxes?

- America Already includes a Progressive Tax Strategy

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percentage’s Tax Charges On Time

- Who Gains from Itemized Deductions?[1] The corporate income tax percentage is that the CBO’s estimate of their prevalence of this tax.

[two ] CBO’s step of means-tested transfers comprises money payments and in-kind transports from national, state, and local governments.

Policymakers have recently proposed various ways of increasing taxes on the wealthiest Americans and creating the tax code more progressive, such as riches taxes, estate taxes, plus a greater marginal income tax rate. Changing the tax program, but requires first understanding the way it currently operates, and what sorts of transfers are already in place.

Data in the Congressional Budget Office (CBO) illustrates the progressivity of the federal tax code and the impact of transfers from high-income to low-income Americans. The subsequent figure shows typical federal tax rates–complete federal taxation divided by total income before transfers and taxes–from income group in 2015.Note: This is part of a blog series called “Putting a Face on America’s Tax Returns”

Even though some taxes fall more heavily on lower quintiles, the net result of federal transfers and taxes is reduced incomes to get high-income Americans and higher incomes for low-income Americans. The next chart shows the shares of income by revenue category prior to and after transfers and taxes.

Taxpayers face greater average federal tax rates as income rises. As an example, individuals at the lowest quintile paid an average national tax rate of 1.5% in 2015, whereas those in the maximum quintile paid an ordinary rate of 26.7 percent.

Questions? Consult an Income Tax Attorney in Vancouver WA.

The end result of all federal transfers and taxes is a redistribution of revenue in large – to low-income households. According to the CBO,”In 2015, average household income before accounting for means-tested transports and national taxes was $20,000 for the lowest quintile and $292,000 for the maximum quintile. After transfers and taxes, these averages were 33,000 and $215,000.” [2] Quite simply, the lowest quintile’s average family income rose by 11,000, while the maximum quintile’s average household income dropped by $77,000.

The lowest quintile’s income nearly doubles, although the second and middle quintiles experience comparatively smaller gains in earnings. The fourth quintile’s income share remains steady, and only the highest quintile has a reduced share of earnings after transfers and taxes. The top 1 percent’s share of earnings, by way of example, falls from 16.6 percent to 13.2 percent.

As policymakers debate means to raise taxes on the wealthy, they ought to keep in mind the degree to which the federal government already transfers earnings between income classes and remember that America currently has a innovative tax program . This circumstance is essential for productive discussions on the best way best to improve the tax code, rather than weaken it.

Source from: http://feedproxy.google.com/~r/TaxPolicyBlog/~3/Vr7lVYuGGTM/

COMMENTS